Introduction

The financial services industry is undergoing a transformation driven by evolving regulations, cyber threats, digital disruption, and rising expectations for operational resilience. Regulatory frameworks such as Basel III and the EU’s new Digital Operational Resilience Act (DORA) are reshaping how institutions govern, manage risk, and architect their IT and business landscapes.

1. Regulatory Drivers: Basel III and DORA

Basel III is a global regulatory standard on bank capital adequacy, stress testing, and market liquidity risk. It aims to improve the banking sector’s ability to absorb shocks and improve risk management. It defines rules for capital buffers, leverage ratios, and liquidity coverage.

DORA (Digital Operational Resilience Act) is an EU regulation set to be enforced by 2025. It mandates that all financial entities—including banks, insurers, and fintech firms—build and demonstrate operational resilience in their ICT systems. Key components of DORA include:

- ICT Risk Management

- Incident Reporting

- Digital Operational Resilience Testing

- Third-Party Risk Management

Both Basel III and DORA demand architectural change—whether it’s ensuring system redundancy, traceability of risk controls, or streamlined reporting and oversight mechanisms.

2. Why TOGAF is Essential for Regulatory Architecture

TOGAF (The Open Group Architecture Framework) offers a structured approach for designing, planning, and governing enterprise architectures. It divides the architecture development process into phases under the Architecture Development Method (ADM), allowing iterative and governance-led progress. Here’s how TOGAF aligns with regulatory compliance:

- Preliminary Phase: Establish architecture vision, stakeholder views, regulatory scope.

- Phase A: Define baseline and target compliance architecture.

- Phase B–D: Design business, application, data, and technology architectures that meet regulatory goals.

- Phase E–F: Plan implementation projects for regulatory gaps.

- Phase G: Establish compliance governance mechanisms.

3. Using ArchiMate for Regulatory Architecture Modeling

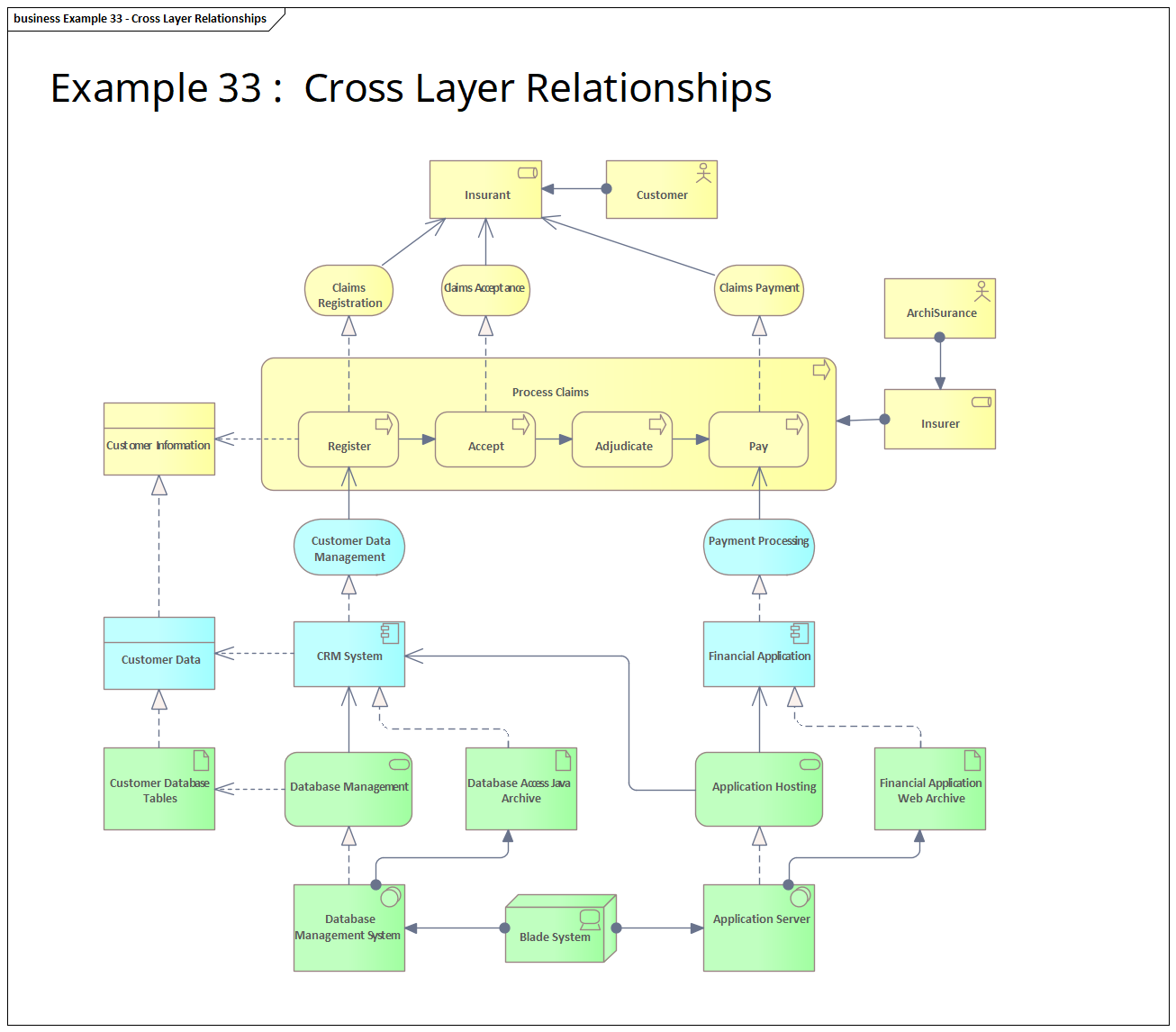

ArchiMate is the industry-standard modeling language for enterprise architecture. It provides a comprehensive metamodel that supports multiple viewpoints. For regulatory modeling, ArchiMate helps by:

- Modeling controls, risk events, and mitigation strategies as Motivation and Business Layer elements.

- Defining application services supporting regulatory reporting, incident logging, or audit trails.

- Visualizing data flow, especially for data lineage and traceability (critical in Basel and DORA).

- Linking requirements to processes, capabilities, and technical components for audit traceability.

For example, a “System Health Monitoring” capability can be traced to application services like “Telemetry Collector” and technical nodes like “Cloud Watch Agent.”

4. Repository Design for Traceability and Evidence

One of the biggest architectural challenges in compliance is ensuring that designs and implementations are fully traceable. This involves:

- Versioning: Tracking architectural baselines as regulations evolve.

- Tagged Values: Annotating components with regulatory attributes (e.g., Basel Pillar association).

- Traceability Links: Connecting requirements to implementations and test cases.

- Audit Views: Creating views in tools like Prolaborate to support internal and external audits.

5. Capability-Based Planning for Regulatory Maturity

Rather than structuring architecture only by applications or systems, capability-based planning focuses on the business value delivered. Compliance can be modeled as a capability domain:

- Core Capabilities: Risk Management, Compliance Reporting, Incident Response

- Sub-Capabilities: Liquidity Analysis, Third-Party Risk Monitoring, Security Audit Management

Each capability is assessed for maturity, coverage, and performance. Heatmaps in EA tools like Sparx EA and Prolaborate can visually depict this for stakeholder engagement.

6. EA Governance and Compliance Reporting

Establishing an Architecture Review Board (ARB) is critical for regulatory oversight. The ARB should define:

- Regulatory architecture principles

- Approval workflows for regulatory-related changes

- Metrics to measure compliance architecture effectiveness

- Reporting dashboards aligned with TOGAF Architecture Repository

7. Integration with Risk and Audit Systems

Modern EA practices increasingly intersect with GRC (Governance, Risk, and Compliance) platforms. EA repositories should expose architecture metadata to tools like:

- OpenPages, RSA Archer for risk aggregation

- Jira or ServiceNow for control implementation status

- Power BI for real-time regulatory compliance reporting

8. Case Study: Basel III Architecture in a Tier-1 Bank

A Tier-1 bank used TOGAF and ArchiMate to model its Basel III compliance architecture. Each risk-weighted asset calculation rule was modeled as a Requirement in the EA repository, linked to:

- Data components (e.g., “Trade Exposure Dataset”)

- Application services (e.g., “Credit Risk Calculator”)

- Technology nodes (e.g., “In-Memory Risk Engine Cluster”)

This allowed complete traceability during audits, enabling compliance evidence generation in under 48 hours—down from 3 weeks.

9. Preparing for DORA: A TOGAF-Based Roadmap

To meet DORA requirements, organizations must architect for resilience and governance. A TOGAF-based approach includes:

- Mapping ICT services and dependencies

- Modeling threat scenarios and associated controls

- Designing testable resilience capabilities

- Documenting and governing third-party providers

Conclusion

Regulatory compliance is no longer just a documentation exercise—it requires architectural foresight, traceability, and agility. By using TOGAF for structured development and ArchiMate for transparent modeling, financial institutions can not only comply with Basel III and DORA but also improve risk posture, resilience, and stakeholder trust.

Basel III, DORA, TOGAF, ArchiMate, Regulatory Architecture, Compliance Modeling, Financial Services EA, Risk Management, Digital Operational Resilience, Enterprise Architecture, Sparx EA, Prolaborate, ICT Risk, Governance Architecture, EA Repository, Capability-Based Planning, Compliance Heatmaps, Architecture Governance, Financial Regulation, GRC Integration, Audit Traceability, Architecture Review Board

If you’d like hands-on training tailored to your team (Sparx Enterprise Architect, ArchiMate, TOGAF, BPMN, SysML, or the Archi tool), you can reach us via our contact page.